vermont state tax return

184 rows 2021 Income Tax Return Booklet 2021 Vermont Income Tax Return Booklet. PA-1 Special Power of Attorney.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

Then click Search to find your refund.

. If you cant file your. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate. Click on Check the Status of Your Return Personal Income Tax Return Status.

Electronic filing allows us to quickly and more accurately process your refund. The 2022 state personal income tax brackets. Residency Status Information for Vermont Returns.

IN-111 Vermont Income Tax Return. To avoid paying interest and penalties have both your taxes paid. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

1 hour agoPhoto by Lisa Scagliotti. Direct Deposit is not available for. Vermont Municipal Equipment Loan Fund Application.

File your Vermont state tax return online with eSmart Tax. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date. Vermont School District Codes.

If you are due a refund or dont owe any tax mail your return to Vermont Department of Taxes PO. To check the status of your. All Forms and Instructions.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. If you file a. Vermont State Income Tax Return forms for Tax Year 2021 Jan.

A taxpayer is a resident of Vermont if they meet one of the following conditions. File My Federal Vermont State Returns. Quick Reference Guide for Vermont Land Gains Withholding Tax Return - Form LGT-177 AND Vermont Land Gains Tax Return - Form LGT-178.

Fact Sheets and Guides. E-File is not available for Vermont. Box 1881 Montpelier Vermont 05601-1881.

This is because the software does the math for you and may catch errors such as omitting a Social Security. W-4VT - Vermont Tax Withholding Form. Allow up to 8 weeks for processing time Call 1-866-828-2865 toll-free in VT or 802-828-2865 local or out-of-statefor information on the status.

W-4VT Employees Withholding Allowance Certificate. IN-111 Vermont Income Tax Return. Income is subject to four tax rates in the state.

Before sharing sensitive information make sure youre on a state government site. Prepare your full-year resident Vermont state tax return and your federal tax return at the same. Vermont State Income Tax Forms for Tax Year 2021 Jan.

109 State Street Montpelier Vermont 05609 Main. State government websites often end in gov or mil. Civil Marriage Quarterly Return Form.

State tax credits will help fund nearly 50 redevelopment projects around Vermont including three sites in downtown Waterbury one of which will. Get your Vermont State Tax Refund Status. Vermont State Tax Filing Information.

Details on how to only prepare and. Is domiciled in Vermont. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a single service.

Preparation of a state tax return for Vermont is available for 2995. Individuals filing state returns submit Vermont Form IN-111.

Vermont Income Tax Calculator Smartasset

Vermont Tax Forms And Instructions For 2021 Form In 111

Property Tax Flyer Halifax Vermont Halifax Vermont Halifax Vermont

Would Be Governors Miss Vermont S New Ethics Law

S1 App Instructions For Business Tax Account

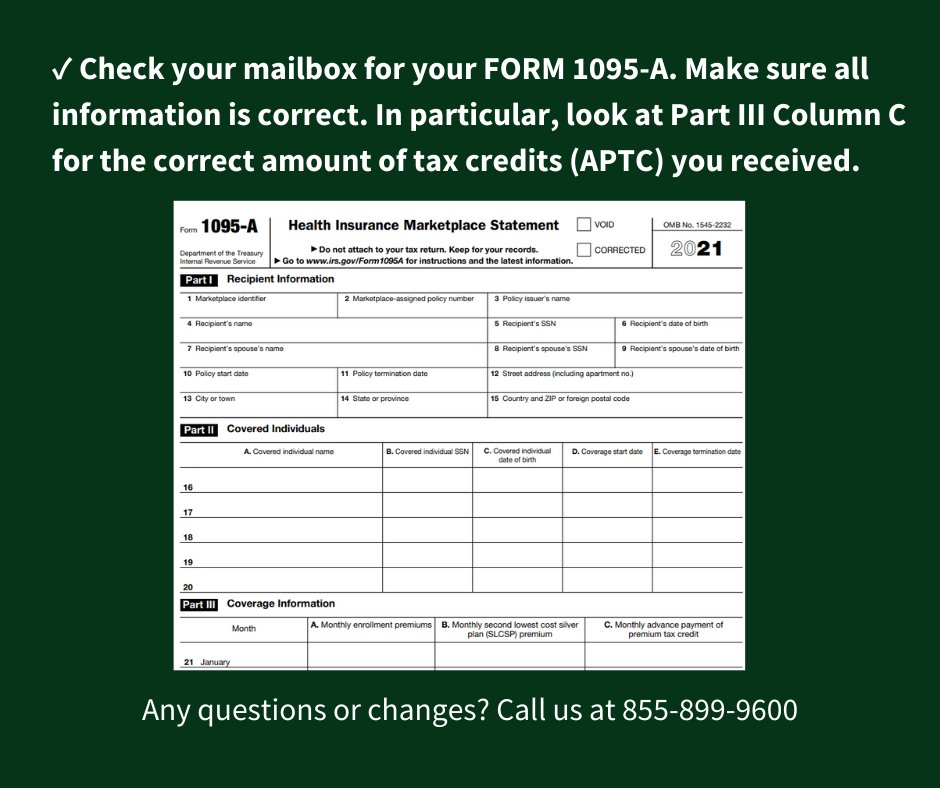

Vt Health Connect On Twitter Ready To File Your Taxes If You Were Enrolled In A Qualified Health Plan In 2021 We Sent You Form 1095 A You Will Need This Form To

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont State Tax Return Etax Com

Vermont Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

Filing A Vermont Income Tax Return Things To Know Credit Karma