sales tax on leased cars in illinois

In Illinois you will pay monthly taxes as of January 1 2015 see Illinois Car Lease Tax. A monthly return is due the 20th day of the month following the month for which the return is filed.

How A Lease Payment Is Calculated

Illinois law has changed so that sales tax applies to the down payment and monthly lease payments.

. Illinois taxes you on any rebates and cap cost reductions ie. Oak Brook Sales Tax. To learn more see a full list of taxable and tax-exempt items in Illinois.

So in your scenario you have about 200 in sales tax on the trade and 30mo for the payment. Saying a SALE is a GIFT is FRAUD. Sales tax and use tax consequences of leasing equipment in Illinois.

Sales tax on car leases in Illinois are changing as of January 1 2015. Public Act 98-628 amends the Retailers Occupation Tax Act and the Use Tax Act to provide for an alternate method. Sales tax and use tax consequences of leasing equipment in Illinois.

If you are in Chicago it is 95 this is separate from the Chicago lease tax. This post provides an overview of the retailers occupation tax ie. If the monthly payment is 300 the sales tax would be 2475 each month.

However there WILL be an audit by the Illinois Department. Sales tax on car leases in Illinois are changing as of January 1 2015. Actual tax rates throughout the state vary because in addition to state taxes the several local taxing bodies that follow the state tax structure have imposed.

Heres how the law works. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. A conditional sales agreement usually has a nominal or one dollar purchase option at the close of the lease term.

The ART-1 is due monthly or annually based on the taxpayers average monthly liability. Based on Public Act 98-0628 effective January 1 2015 lease payments made on certainvehicles that are leased for a period of 12 months plus one day with an option to continue leasing on a monthly basis were not subject to Illinois sales and use tax on the lease receipts because the lease is not for a defined period. If the down payment is 2000 the tax on that would be 165.

Previously taxes were based on the full value of a. Most people deduct income tax but in the case that you made several large purchases you will probably receive a larger refund by claiming sales tax. If the lessor is guaranteed when entering into the lease agreement that the leased property will be sold Illinois law considers the transaction to be a conditional sale and the lessor to be a retailer making a sale of tangible property which subjects all receipts to sales tax.

Tax will not be paid with monthly payments not up front on entire value of vehicle. The se lling price for leased motor vehicles is determined either by the actual selling price or the amount due at lease signing plus the total amount of payments over the term of the lease. If the monthly.

While Illinois sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. Certain Car Lease Payments Not Taxable in Illinois.

Despite this new sales tax this will go towards new initiative to fund to. I spoke to the IL dept of revenue and they have never heard of this 30 tax. The vast majority of cars in the United States and Canada for that matter are equipped with automatic transmission - manual stick shift cars are very much the exception to the rule.

Money down and trades plus your monthly payment. Toyota of Naperville says these county taxes are far less and tend to range from 025 - 075. The statewide sales tax rate is 625 collected by the Illinois Department of Revenue with 125 being returned to local governments where the goods were purchased.

The alternate selling price eg the amount due at lease signing plus the total amount of payments over the term of the lease must be used when a qualifying motor vehicle is sold for the. Illinois taxes you on any rebates and cap cost reductions. So your total payment is 335mo 20036 30 300.

Car leasing in Illinois will become much less expensive on January 1 2015 due to changes in the applicable tax law. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. At mytaxillinoisgov I selected Businesses then Tax Rate Finder.

The total tax for a 36-month lease would be 1056 or 1419 less than under the current formula. Under Illinois law true leases and conditional sales often referred to as 1 outs are subject to different tax treatment. Like with any purchase the rules on when and how much sales tax youll pay.

If the down payment is 2000 the tax on that would be 165. What is a lease. If youre buying a car for 40000 and your trade in is worth 20000 you only have to pay tax on the difference which in this case is 20000.

The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. When you sell your car you must declare the actual selling purchase price. The department determines how often a return must be filed.

Hi all I am looking at leasing a car and the salesman I spoke to quoted a 925 sales tax on top of a 30 monthly tax which would make the payments significantly higher than I was expecting. Titled or registered items Illinois retailers selling items that are of the type that must be titled or registered by an agency of Illinois state government ie vehicles watercraft aircraft trailers and mobile homes must register with the Department to report these sales using Form ST 556 Sales Tax Transaction Return. According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes.

Sales tax is a part of buying and leasing cars in states that charge it. 1 the Illinois law will change so that sales tax applies to the down payment and monthly lease payments. Form ART-1-X Amended Automobile Renting Occupation and Use Tax Return Instructions.

Illinois has issued a bulletin to explain changes affecting the basis for determining the selling price for certain motor vehicles sold in order to be leased for a period longer than one year for sales and use tax purposes. This page describes the taxability of leases and rentals in Illinois including motor vehicles and tangible media property. Across the state drivers can expect an average trade-in sales tax of 874 while those in Chicago can expect a sales tax near 1025.

The states sales tax to trade-in will now be a cost drivers around 625 while municipalities may have an average sales tax of 249.

How To Profit From An Off Lease Car Kelley Blue Book

How Do I Sell My Leased Car To A Third Party

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How Does The Inventory Shortage Impact Leasing News Cars Com

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How Does The Inventory Shortage Impact Leasing News Cars Com

What Is A Lease Buyout Keep Your Leased Car Or Sell It Nerdwallet

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

How Much Does It Cost To Lease A Car

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

The 3 Questions That Are Important For Buying A Car In Arlington Texas No Money Down Car Lots In Arlington Tx Car Loans With Bad Credit Corporate Business

Is Your Car Lease A Tax Write Off A Guide For Freelancers

7 Steps To Getting A Great Auto Lease Deal Nerdwallet

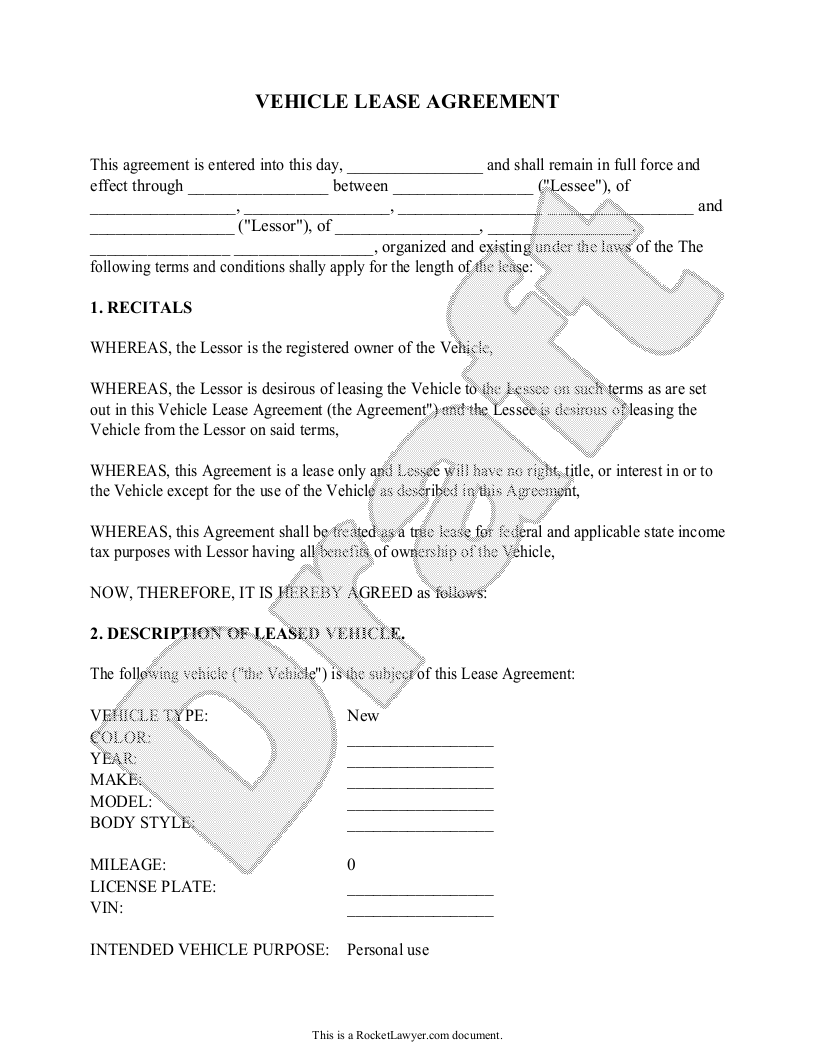

Free Vehicle Lease Agreement Make Sign Rocket Lawyer

How Much Is A Tesla Lease In 2022 Electrek

Should You Put A Big Down Payment On A Car Lease Carfax

What S The Car Sales Tax In Each State Find The Best Car Price