missouri gas tax increase 2021

When the debate focused on the impact of the fuel tax supporters talked of the safety improvements the money will buy for highways. Vehicle weighs less than 26000 pounds.

How To Get A Missouri Gas Tax Refund As Gas Prices Increase

1 but Missourians seeking to keep that money in their pockets can apply for a rebate program.

. Gas tax increase The Missouri Senate also passed legislation on Thursday that would raise the states gas tax. 1 drivers filling up in Missouri will pay an additional 25 cents per gallon of gas. Governor Parson signed this into law back in May as a way to pay to fix.

The legislation includes a rebate process where drivers could get a refund if they save their gas receipts and submit them to the state. The Missouri Legislature has passed a proposal that would boost the states gas and diesel tax for the. There is a way for Missourians to get that increased tax money back though.

It was the first gas tax hike in 25 years but it will keep increasing by 25 cents per gallon every year until 2025 according to. Prior to October 1 2021 the motor fuel tax rate was 017 per gallon. The tax would go up 25 cents a year starting in October 2021 until the increase.

Use this form to file a refund claim for the Missouri motor fuel tax increases paid beginning October 1 2021 through June 30 2022 for motor fuel used for on road purposes. The bill includes a refund program for highway vehicles. A proposal up for consideration would raise the states gas tax 25 cents per gallon every year for the next four years generating a total of.

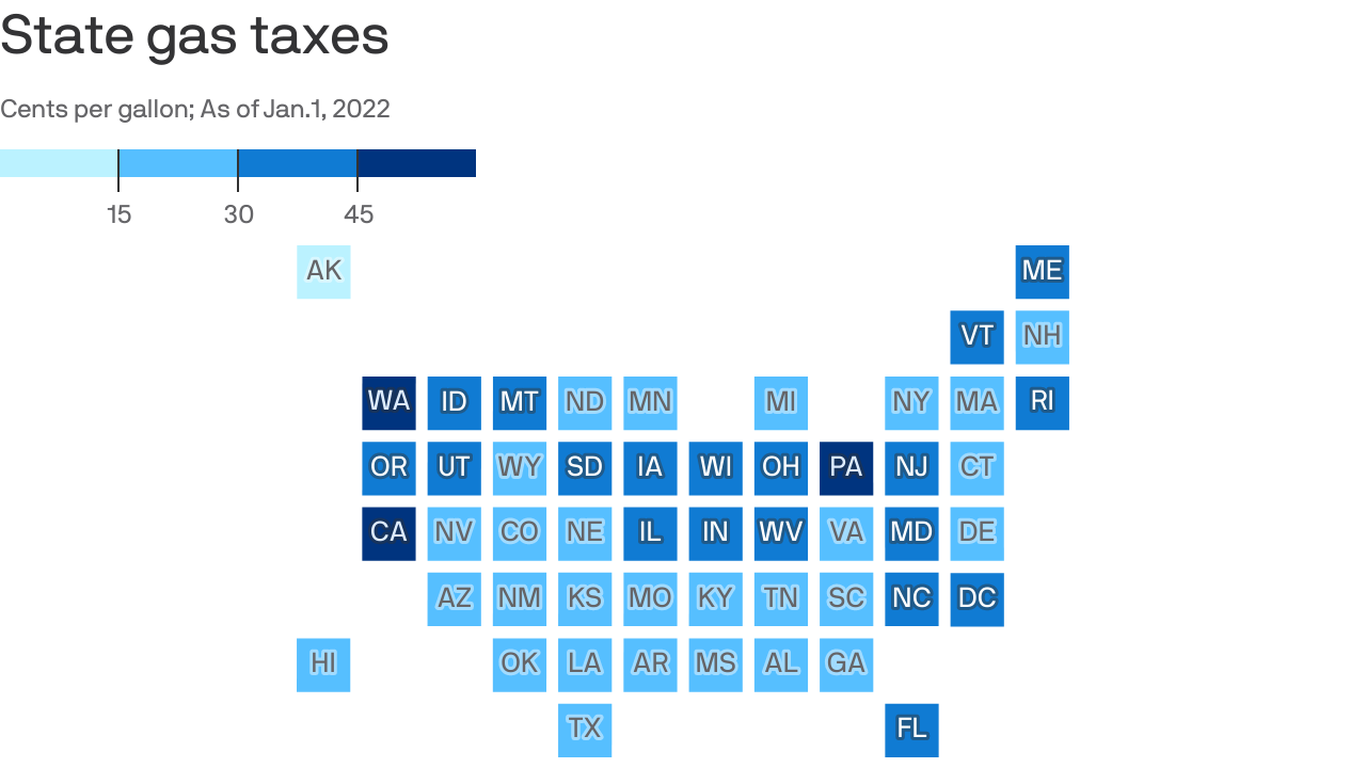

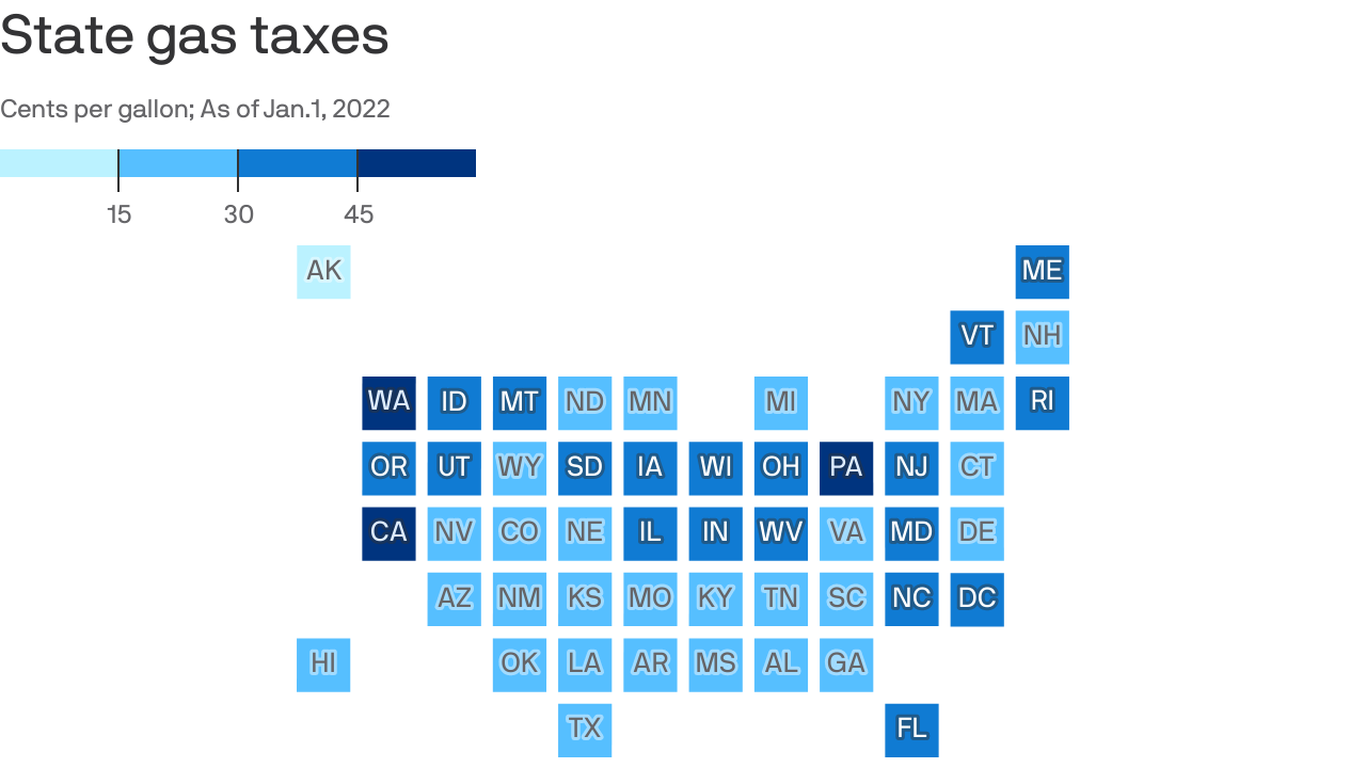

May 10 2021 By Alisa Nelson. Refunds must be filed on or after July 1 but not later than September 30 following the fiscal year for which the refund is claimed. The lowest state gas tax rates can be found in Alaska at 1498 cents per gallon followed by Missouri 1742 cpg and Mississippi 1879 cpg.

1 2021 through June 30 2022. Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. On October 1 2021 Missouris motor fuel tax rate increased to 195 cents per gallon.

1 until the tax hits 295 cents per gallon in July 2025. Fridays increase will bring Missouris gas tax to 195 cents. Missouri has one of the lowest gas tax rates in.

It is part of the gas tax bill lawmakers passed and Governor Mike Parson approved on July 13. Starting Friday Oct. Vehicle for highway use.

1012021 6302022 Motor Fuel Tax Rate increases to 0195. KY3 - Missouris gas tax increase will go into effect on Friday. On October 1 Missourians will see a price increase of 25 cents per gallon.

Missouri voters havent approved of a gas tax increase since 1996. You may be eligible to receive a refund of the 25 cents tax increase you pay on Missouri motor fuel if. Fuel bought on or after Oct.

The bill would raise Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. 1012021 6302022 Motor Fuel Tax Rate increases to 0195. May 12 2021 By Alisa Nelson.

The state will incrementally increase the gas tax by 25 cents annually with the funds earmarked for road and bridge repairs. It increased the tax by six cents a gallon in three two-cent steps. 1 until the tax hits 295 cents per gallon in July 2025.

Senate Bill 262 increases the Missouri motor fuel tax rate over five 5 years by two and one-half cents per year with the first increase beginning on October 1 2021 and increases each year as follows. 29 2021 at 503 PM PDT. 712022 6302023 Motor Fuel Tax Rate increases to 022.

Missouris gas tax will go up by 125 cents over the next five years 25 cents a year starting this October. In this final week of the Missouri Legislatures regular session a proposed gas tax hike is expected to jump into the drivers seat. Fuel tax revenues are dedicated to highway uses including the Missouri State Highway Patrol.

By Cameron Gerber on September 30 2021. The first 25-cent increase is slated to take effect in October which will bring the gas tax to 195 cents. By Elias Tsapelas on Oct 22 2021.

The Missouri Senate passed a tax bill earlier this month that would increase the states 17-cent gas tax for the first time in decades. The tax is set to increase by the same amount yearly between 2021 and 2025. The House of Representatives.

The bill raises Missouris 17-cent-a-gallon gas tax among the lowest in the nation by 25 cents a year starting Oct. California pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg. At the end of 2025 the states tax rate will sit at 295 cents per.

Missouris first motor fuel tax increase in more than 20 years takes effect on Oct.

Natural Gas Prices Forecast Predictions For 2022 2023 2025 2030 Primexbt

Gov Mike Dewine Says Despite High Gas Prices It Would Be A Mistake To Roll Back Ohio Gas Tax Cleveland Com

U S States With Highest Gas Tax 2022 Statista

States With The Highest And Lowest Gasoline Tax

Missouri Lawmakers May Ask Voters To Raise Gas Tax In 2021 Transport Topics

States With The Highest And Lowest Gasoline Tax

New Poll 81 Of New Yorkers Want To Choose Clean Energy Energy Hydro Energy Renewable Energy Companies

Pin By Joe Zahn On Quick Saves Weather Watch Law Enforcement Agencies Segmentation

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Long Has It Been Since Your State Raised Its Gas Tax Itep

States With The Highest And Lowest Gasoline Tax

Polestar 2 Magnesium Factory Issued Press Photo Uk 2020 Landschaftsbilder Landschaft

Why Do Vancouver Drivers Pay So Much For Gas Citynews Vancouver

Congress Considers Suspending The Federal Gas Tax Fortune

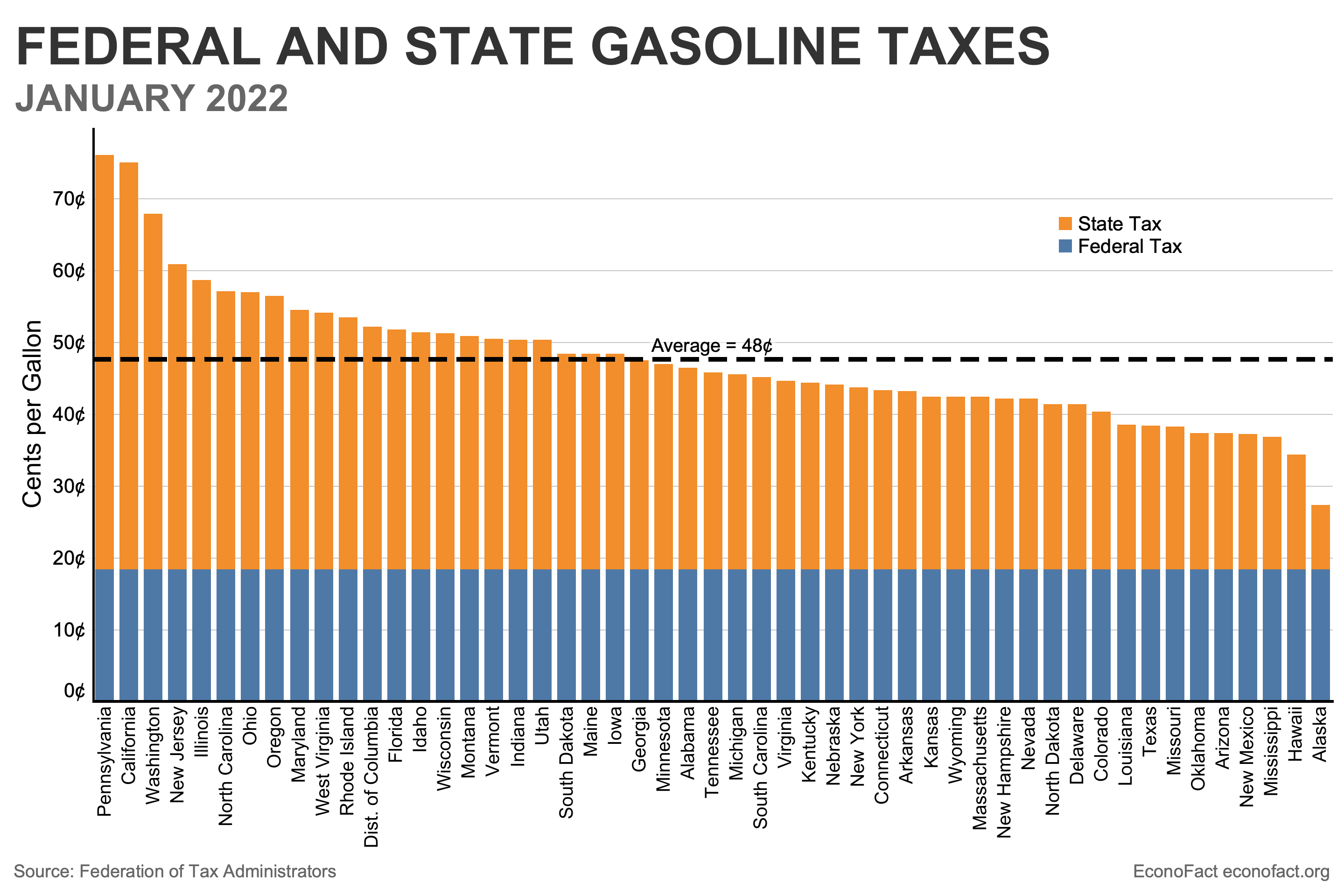

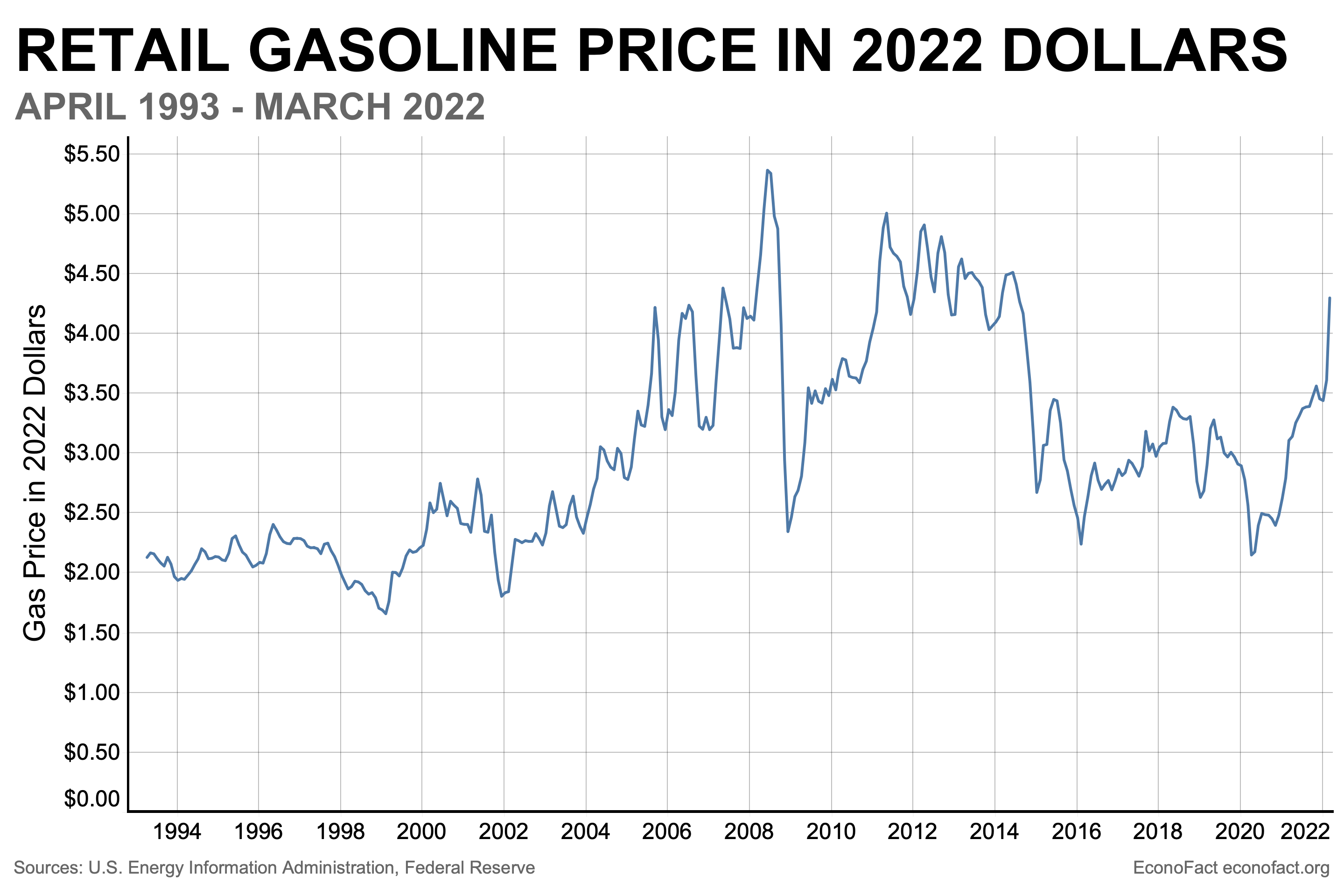

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Transcanada S Columbia Pipeline Acquisition Should Help Drive Multiple Expansion Columbia Graphing Map

Oil Prices Are In Turmoil Right Now Here S What You Need To Know Npr

Colorado Reticent To Lower Gas Taxes Amid Soaring Prices Axios Denver

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact